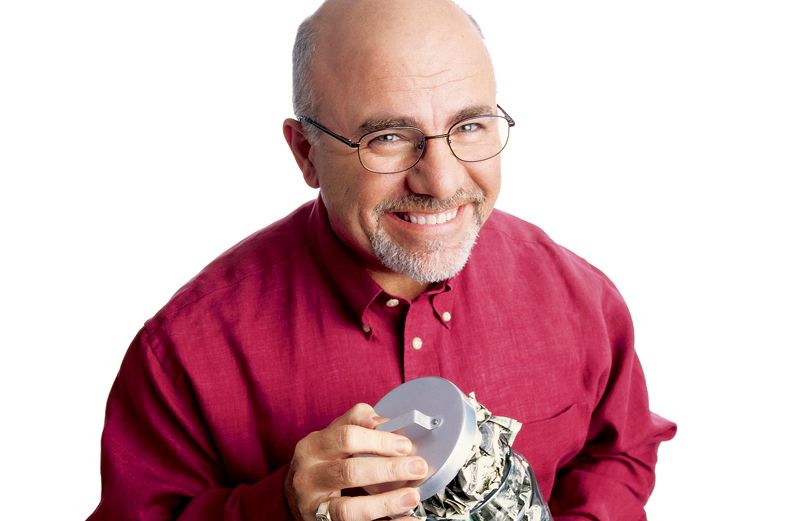

Nice clothes, shiny Jaguar, platinum credit card. No one would have guessed I was in a hole. Deep!

I didn’t have cash to spare for a tank of gas. Instead, that day in 1988 I handed the filling station attendant my gas card and stood there at the pump asking–no, begging–God, I just need a few gallons. Please don’t let my card get turned down.

I was so broke and debt-ridden I didn’t know if my wife, Sharon, and I could ever recover.

It was the go-go 1980s and, still in my twenties, I’d made a killing in real estate. I bought and sold property right and left. If one bank turned me down for a line of credit I just went to another. I was a millionaire. On paper.

In reality, I was up to my eyeballs in loans. It all came crashing down when my biggest lender got sold. The new bank wanted their money back. They gave me 90 days to come up with $1.2 million.

Over the next two years, Sharon and I lost everything but our home and the clothes on our backs. Even our furniture was hauled away.

So who am I to help you with your family finances? I’m the guy who hit bottom and lived to talk about it. It took years for me to fight my way back to financial peace, but I did it.

Along the way I discovered that my finances had less to do with money and more to do with values, self-esteem and, yes, even my relationship with God. Here are some of the most important things I learned.

1. Save for those rainy days.

When it rains, it pours. And it always rains sooner or later, no matter what our blessings. Seventy-five percent of Americans will go through a major negative life event in any given 10-year period.

Your job gets downsized or outsourced. Your basement floods. The transmission falls out of your car. You get sick. A spouse dies. Life happens, so be ready.

One survey I came across said that half of all Americans don’t have enough put away to cover even one month’s expenses. Those folks have virtually no buffer between them and life’s bumps. Remember, there will be rainy days. If you use a credit card as an umbrella, you’ll end up soaked all over again.

How do you get an emergency fund started? Save $1000 in cash, as fast as you can! Get intense! Do whatever it takes. Cut expenses, work extra shifts, have a garage sale, sell so much stuff the kids think they’re next. Just do it!

When you’ve got the money, earmark it for emergencies only. This is not a vacation fund or Christmas-gift savings. It’s the beginning of your financial safety net. Once you’re out of debt, you’ll need to build up six months’ living expenses, but start with that thousand dollars.

By the way, I’ve noticed that people in money messes try to get out of debt before anything else. Then they face an emergency. They stop paying their debt and instead add to it. As a result, they feel guilty, and their downward spiral continues.

You can break this cycle by having a small cushion in place before paying your creditors.

I learned the hard way the importance of having ready cash. That day at the gas station my credit card didn’t get rejected. But I vowed not to find myself in that situation again.

I built my own emergency fund. I sold my Jag. A friend of mine gave me a “new” car. It was an ancient Cadillac with about 400,000 miles on it. It wasn’t a pretty-looking ride, but it got me where I needed to go.

Today I am certain that Sharon and I dug ourselves out of our financial hole in part because we drove beat-up old cars, wore consignment-sale clothes, stuck to a budget and cut up the credit cards. Humility is a powerful force for personal change, especially financial humility.

2. Get cured of “stuffitis.”

We all suffer from it. “Stuffitis”–the desire for more stuff. The newest, the best, the biggest. It’s like a disease, and it can be fatal to your financial well-being. Credit cards are the enabler, making it easy for people to buy stuff they don’t need and can’t afford. When you pay cash, it hurts.

There is only one way to get over it: Stop spending. Use the envelope system. Split your paycheck into categories-entertainment, clothing, gas, groceries and so on-and set out an empty envelope for each one. Fill each envelope with cash to cover the amount you’ve allotted.

When you go shopping, take that envelope with you. Spend all you want, but when the envelope is empty, stop spending! The system is as simple as that, and it works. Sharon and I have been using it for more than 15 years.

To treat severe, chronic stuffitis you need a “plasectomy”–amputate the credit cards. Get the family together to cut the cards into tiny pieces. I can hear you already: “Dave, how are we supposed to rent a car? Check into a hotel? Buy things on the internet?”

Get a debit card. It works like a credit card, but you can only “charge” something that you can pay for immediately out of your bank account, so no carry-over balances, the interest on which does more to wreck family budgets–and dreams–than anything I know.

If you don’t have the cash, your debit card won’t work. I can do everything I can with a debit card that I can do with a credit card … except go broke!

3. Be delivered from debt.

The Book of Proverbs says, “The borrower is slave to the lender.” It also says something like, “If you have any debt, deliver yourself like the gazelle from the hand of the hunter.” Translation: The way out of debt is to run for your life!

God’s loving plan is for you to be free, not to be chained down by creditors and huge interest payments. Get out of bondage; pay off the debt! If you own something you can’t pay for in 18 to 20 months, sell it.

And work extra hours. My grandmother used to say, “There is a great place to go when you’re broke: to work!”

Use the Debt Snowball. List all of your debts in order, from the smallest to the largest. All your debts, even loans from Mom and Dad, whether there’s interest on them or not. Pay the minimum amount on all your debts, except for the smallest.

Scrounge together every extra dollar you can and put it toward paying off that smallest debt. Once it’s paid off, take the payment amount and any other “found” money and put it towards the next smallest debt.

When debt two is gone, pay the minimum on debt three plus what you had been paying on one and two. If you do this, you’ll be debt-free (except for your house) sooner than you would imagine. Then you can get back to building up your emergency fund.

4. Make money work for you.

Once you’ve taken care of your past–that mountain of debt–start taking care of your future. Put money away for retirement. Keep in mind, when I say “retirement” I mean “security.”

Security is the ability to make choices: Write a book; spend time with the grandkids; travel; or just swing in a hammock.

Yes, God demanded that Adam and his descendants work for a living, but he also wants us to be content in our old age. You want to reach the point where your money works harder than you do.

How do you do that? Invest 15 percent of your gross income. The best place is a good mutual fund (do some research to learn what these funds are about and how to invest in one).

That’s where I put my money. Mutual funds with long track records are great because they give you diversification and professional management.

You have to be serious about investing a set amount every month in the fund of your choice. And leaving it alone to collect interest. Start small and watch it grow. Systematic, consistent investing over time is the tortoise that beats the hare.

5. Share the wealth.

Back in my twenties I was what I like to call “enthusiastically stupid.” No one is born financially smart. And the majority of people in this country are never taught how to manage money wisely. If you are over the age of 12, you’ve made money mistakes. However, that’s nothing to be ashamed of.

Once you learn, teach your children, even your grandchildren. Start them young, but not with an allowance. Instead, teach them the value of work by giving them a “commission” for each task or chore completed. That way they learn that finishing a job can result in a financial reward.

Then teach them how to spend wisely. Tell them they can get that fancy video-game system if they stop buying candy every day and start saving. Have them set a goal for a big purchase. Divide the total cost by the amount that needs to be saved each week or month.

The satisfaction of buying something on their own, without borrowing money, is an invaluable lesson in building self-esteem.

The best thing you can do, and teach your kids, is to give. I’ve met thousands of millionaires, and what the healthy ones have in common is a love of giving. Building wealth enables you to give more financially.

A lot of times you won’t be able to help someone if you don’t have enough money. Scripture says that we are expected to tithe and to help the poor. Take the Good Samaritan. He reached into his own pocket to pay an innkeeper to take care of an injured stranger.

Would we ever have heard of the Good Samaritan if he hadn’t had those “extra” shekels clinking around in his cloak? Money gives power to good intentions.

It took Sharon and me about seven years to climb out of our financial pit. It wasn’t easy. But it was necessary, and the greatest blessing we’ve received–even greater than the blessing of security–is the chance to help people less fortunate than ourselves.

That is the one debt I will never retire: my gratitude to a generous God.

Download your FREE ebook, Paths to Happiness: 7 Real Life Stories of Personal Growth, Self-Improvement and Positive Change